London

08 February 2009

Britain's Treasury Secretary has ordered an independent review into the bonus structure of British banks that are being propped up by the British taxpayer.

Media reports here indicate that The Royal Bank of Scotland may be considering bonus payments this year totaling around $1.5 billion.

|

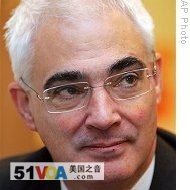

| Britain's Chancellor of the Exchequer Alistair Darling (File) |

"No one that is associated with these large losses should be allowed to walk away with large cash bonuses," said Darling. "Now, obviously, there are contractual problems with some staff, and, indeed, if you look at, if your average teller across the counter, who you meet -- they are not terribly well paid, and I do not think anyone would quarrel with making sure they are properly rewarded."

RBS received a $30 billion lifeline from the British taxpayer in October and it expects record losses for 2008.

With the public now holding a 68 percent stake in the institution, Darling says big bonuses will no longer be viewed as business as usual.

"What is wrong though is that, where[as], in the past, a bonus was something special you got as a result for hard work, or you are putting in an extra effort, over the years, a lot of bankers have come to expect, it is a right, very large bonuses, and that just cannot go on."

The treasury spokesman for the main opposition Conservative party, George Osborne, agrees that the way banks operated in the past will no longer be tolerated.

"The party is over for the banks. You cannot go on paying yourselves 20 times what a heart surgeon earns," said Osborne. "So, that whole culture has to come to an end, and I think the bankers, and, indeed, the government have to understand, you cannot just re-inflate the balloon that burst. You have to look to a new banking settlement, a new economic model that is much more stable."

Alistair Darling says he will announce who will chair the review into bank bonuses and risk-management on Monday.

U.S. President Barack Obama has imposed a $500,000 cap on the salaries of top American executives at some banks receiving taxpayer money.