Washington

10 June 2009

A congressional overseer of the U.S. government's efforts to rescue the financial system said a massive infusion of federal funds intended to ease a severe credit crunch has only partially succeeded, with many ailing banks using the money to survive rather than making new loans to businesses and consumers.

During last year's financial meltdown, the Bush administration argued that government action was required to combat tight credit conditions that were choking the U.S. economy. Officials like former Treasury Secretary Henry Paulson insisted back then that the nation's banking sector was vibrant and healthy, despite a lack of lending.

|

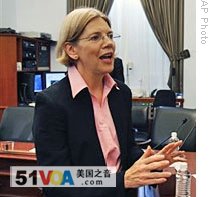

| Dr. Elizabeth Warren, chair of the Congressional Oversight Panel speaks with congressional members (not seen) on Capitol Hill, 09 Jun 2009 |

But that assertion proved wrong, according to Congressional Oversight Panel chairperson Elizabeth Warren, who said that hundreds of billions of dollars in federal funds did more to prop up struggling banks than ease credit conditions.

"In fact, the banks were not healthy. And when we stuffed this money into them, they just held on to it. And they held on to it, many of them, just as reserves," he said.

Warren was speaking on CBS's "Early Show".

Tuesday, the Treasury Department announced it will allow 10 of America's largest banks to repay a total of $68 billion in emergency government aid. President Barack Obama welcomed the news as a sign of progress in reviving America's financial sector.

But Elizabeth Warren said the true health of American lending institutions is hard to judge, because of flaws in so-called "stress tests" the government administered to banks earlier this year. The tests were designed to gauge the ability of major banks to withstand further economic shock.

Testifying on Capitol Hill Tuesday, Warren noted that, at 9.4%, the current U.S. unemployment rate already exceeds the rate that was assumed as a worst-case scenario for the stress tests.

"Let's face it. The [economic] numbers are bad and they have headed in the wrong direction. This is a real concern: that the worst-case scenario right here in 2009 is, in fact, not the worst case. And that we are going to see worse numbers than that," he added.

Warren also criticized the stress tests for gauging banks' health through the end of 2010. She argued that America's real estate woes -- particularly in the commercial sector -- could extend well beyond that date and harm banks for years to come.

But others have argued that the essential factor when it comes to boosting stability in the banking sector cannot be measured by statistics or economic formulations. Bank analyst Richard Bove of Rochdale Securities:

"The key issue is: do we have confidence in the banking system? And I think confidence is back," he noted.

Ten of 19 U.S. banks subjected to stress tests were deemed undercapitalized and ordered to raise a total of $75 billion. Most have either met their targets or are close to doing so.